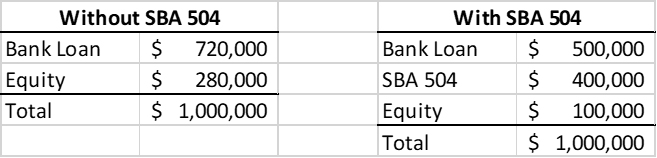

Loan Calculator

The information provided by these calculators is for illustrative purposes only and accuracy is not guaranteed. The default figures shown are hypothetical and may not be applicable to your individual situation. Be sure to consult a BLP financial professional prior to relying on the results.

This calculator does not have the ability to pre-qualify you for any loan program. Qualification for loan programs may require additional information such as credit scores and cash reserves which is not gathered in this calculator. Information such as interest rates and pricing are subject to change at any time and without notice. This calculator does not calculate the Annual Percentage Rate or Average Prime Offer Rates. BLP does not guarantee any of the information obtained by this calculator.

CONTACT US